Most of my portfolio is in mutual funds rather than individual stocks. This allows me to diversify a bit more easily without the added cost of trading. Also, it doesn’t open yourself up to as much volatility as ETFs can experience, since they’re subject to the whims of market emotions just the same as individual stocks.

Mutual funds have one very big problem, though: you do not know the share price at which you’re going to be buying and selling them like stocks. With stocks, you list a price you want to buy / sell at and your broker makes sure you pay / get paid exactly that (after taking a commission, of course). You have to buy into mutual funds (slightly different than purchasing a share of stock), and have to initiate it during trading hours, usually. Mutual funds have their prices set (actually called a NAV), some time after the close of the market, however – usually around when people leave for the day.

Setting aside the reasons why this is the case (which I understand and am not arguing with at all), this makes buying into and cashing out of mutual funds relatively risky. One nice thing about mutual funds is that they publish their holdings (at least to some people looking to sell that data). The top 10 are freely available at places like Google and Yahoo!; however, Morningstar displays to users up to 25 (they try to charge for the top 100). You can start to predict what the prices of the mutual funds are going to do based on the holdings did that day. If all of the holdings went up 1%, the NAV of the mutual fund will tend to go up 1%. This correlation is less descriptive of funds which you know less of the total composition (say they had 300 positions total), have a higher turnover rate (buying and selling of their positions a lot), or are leveraged (borrowing in order to buy in extra).

So, I decided to make another script to help me with the intra-day decisions about whether or not to buy or sell mutual funds that day. It will take the mutual fund ticker, grab the holding and composition data from Morningstar, and then will attempt to get the information about all of the holdings and predict a percentage increase. This gives me a rough idea as to whether or not today is a good day to buy into or cash out of mutual funds. I always try to do the buying on low days and the selling on high days (who’d have guessed that, anyway?).

There are some inaccuracies in this, of course. In addition to the ones listed above, there’s also the fact that bond prices / yields aren’t always published individually, so funds have hold bonds aren’t very well predicted. Also, mutual funds only usually publish their holdings quarterly, so as the quarter goes on, the holding percentages might change, but this can only predict based on the data known from the last publishing.

Anyway, like my TSP script, I am hosting and developing it on GitHub: https://github.com/elaske/mufund. I’ve added a bunch of issues describing some of the features I wish to implement in the future, along with the goals of this initial script. Comment on GitHub or here if you have any suggestions!

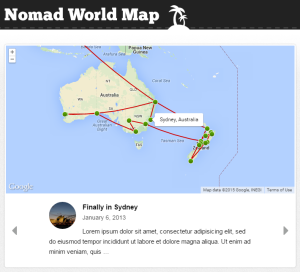

When setting up this site, I knew I’d want to talk about where I’d been. I had done so before previously by putting together a Google Map that had all of my travel destinations for the trip. This got cumbersome and was relatively featureless. I went searching at first for just a way to embed this kind of information into a post or a page and stumbled upon Nomad World Map.

When setting up this site, I knew I’d want to talk about where I’d been. I had done so before previously by putting together a Google Map that had all of my travel destinations for the trip. This got cumbersome and was relatively featureless. I went searching at first for just a way to embed this kind of information into a post or a page and stumbled upon Nomad World Map.![Share-Price-History-Data[1]](http://www.elaske.com/wp-content/uploads/2015/02/Share-Price-History-Data1.png)

I’m a person that likes to keep track of their finances intently, along with someone that likes a lot of data and looking through that data. Unfortunately, these two desires start to fall apart once it gets to my retirement. As a federal employee, I have the “Thrift Savings Plan” for my funded retirement savings. The TSP is great in a lot of ways; for instance, it’s got expense ratios on it’s funds that are an order of magnitude lower than the lowest funds elsewhere (0.027%). It keeps these expense ratios low (along with the expenses to the government) by limiting a lot of things that you might find in other private retirement systems. For instance, we have only 5 funds to invest in, and another 5 “lifecycle” funds that invest in those 5 funds adjusting their allocations automatically.

I’m a person that likes to keep track of their finances intently, along with someone that likes a lot of data and looking through that data. Unfortunately, these two desires start to fall apart once it gets to my retirement. As a federal employee, I have the “Thrift Savings Plan” for my funded retirement savings. The TSP is great in a lot of ways; for instance, it’s got expense ratios on it’s funds that are an order of magnitude lower than the lowest funds elsewhere (0.027%). It keeps these expense ratios low (along with the expenses to the government) by limiting a lot of things that you might find in other private retirement systems. For instance, we have only 5 funds to invest in, and another 5 “lifecycle” funds that invest in those 5 funds adjusting their allocations automatically.![logoJIRAPNG[1]](http://www.elaske.com/wp-content/uploads/2013/11/logoJIRAPNG1-300x163.png)